Who is this information for:

- Petitioners/Sponsors of foreign nationals, including spouses, parents, children, and siblings

- Co-Sponsors

- Joint Sponsors

If we have asked you to obtain and submit tax documents for your immigration case or a case on which you are a co-sponsor or joint sponsor, we ask that you do NOT send us copies of tax returns you have previously filed.

Instead, we strongly urge you to obtain a Tax Return Transcript from the IRS. This document is preferred by USCIS because it condenses the information, and is evidence that the return was actually filed with the IRS.

Obtaining a Tax Return Transcript is easy. It can be done online, or by telephone. Here is how:

IRS.gov

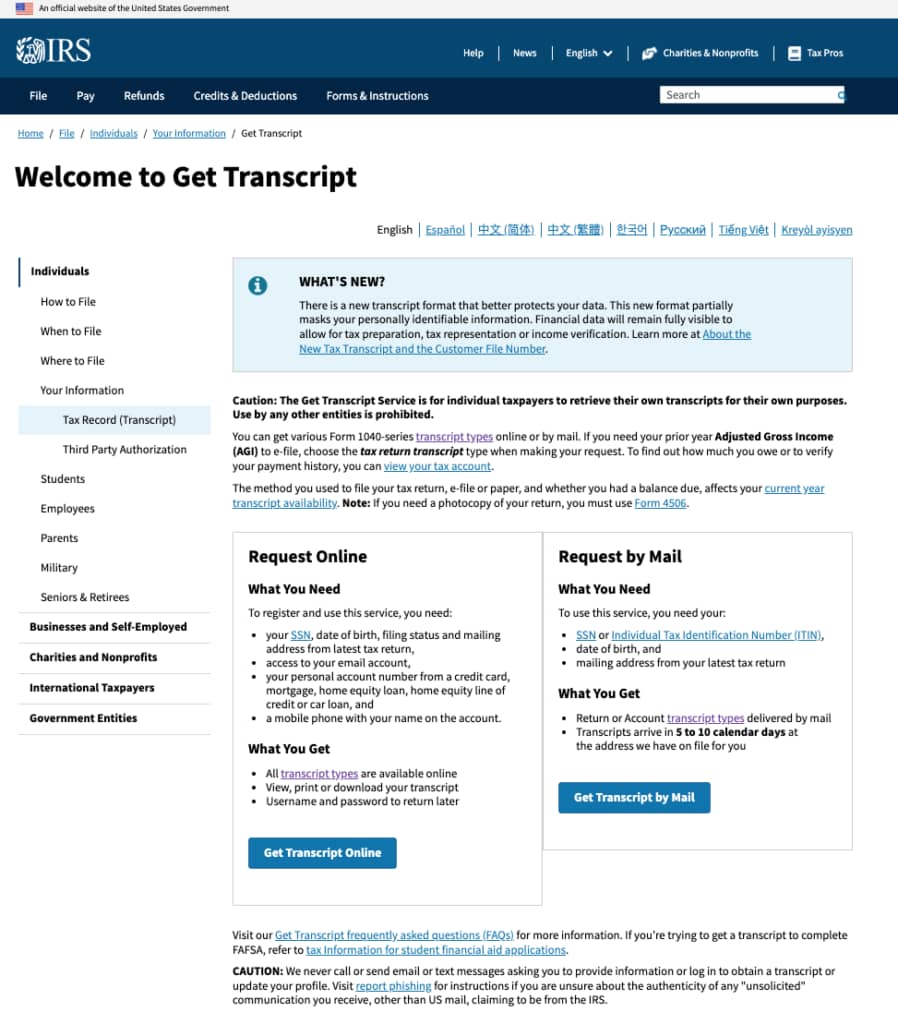

Navigate to https://www.irs.gov/individuals/get-transcript

You can request the correct transcript online by following the link. If you do not have an IRS.gov account, you can register on the page.

If you prefer not to register, you can request the document over the phone by calling 800-908-9946. Expect delivery to take between 5 and 10 business days when ordering over the phone.

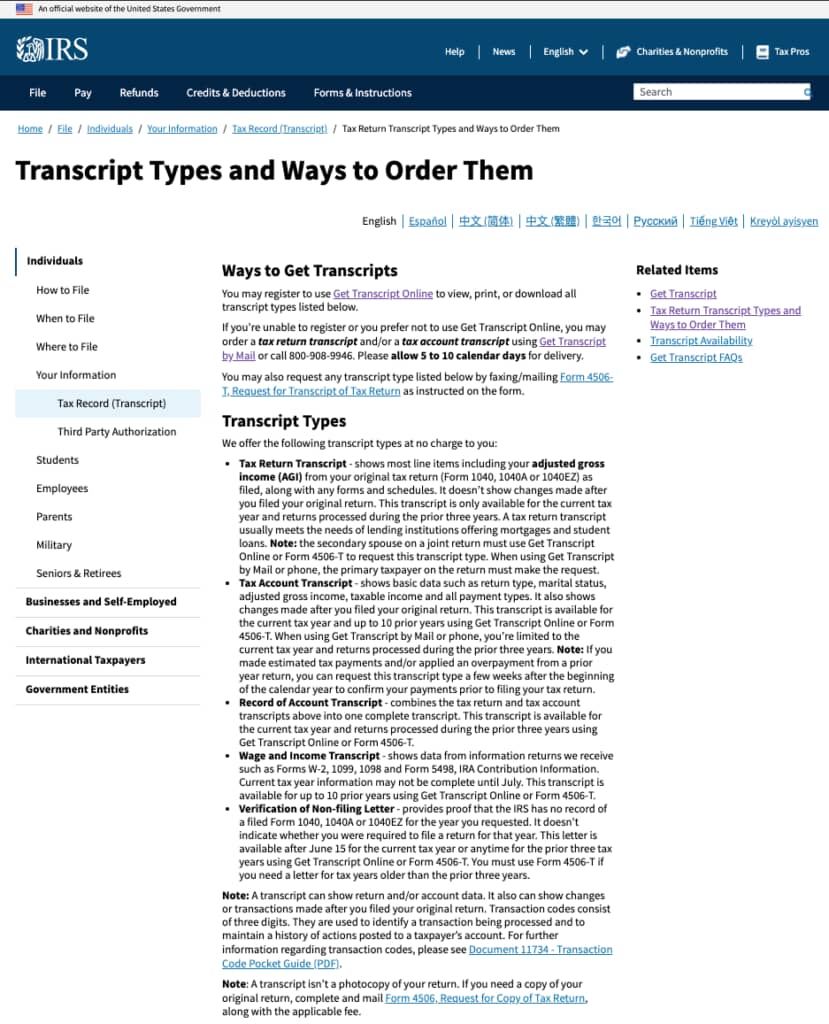

Transcript Type:

There are many types of transcripts you may request. Please make sure you you select TAX RETURN TRANSCRIPTS

If, for any reason, you are unable to obtain a Tax Return Transcript from IRS.gov, and instead you intend to submit copies of your tax returns, you must provide returns that are SIGNED.

Copies of unsigned tax returns are not accepted by USCIS, as there is no indication that the return was filed with the IRS.